The prices of a small set of heavily shorted stocks spiked last week as multiple factors conspired to create an intense demand for shares of some companies. The extreme move in prices has created a large gap between the current price and the price targets of even the most optimistic investors.

Key Points for the Week

- The prices of some heavily shorted stocks spiked as market dynamics created intense demand for shares of some companies. Other companies rallied on hopes a similar dynamic could be created for them, too.

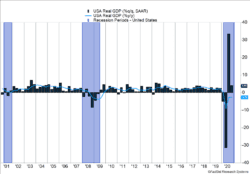

- U.S. GDP rose 4.0% in the fourth quarter. The economy has recovered three-quarters of the economic decline experienced in the first half of 2020.

- Disposable income rose 0.6% in December as employee compensation increased 0.5%.

Returning to more pedestrian news, the U.S. economy grew 4.0% in the fourth quarter. GDP is 2.5% lower than the fourth quarter of last year. In 2020, the economy shrank 3.5%. Positive business investment was offset by slower goods purchases. Services grew 1.8% and were pressured by surging virus cases in the fourth quarter.

Global stocks retreated on the news. The S&P 500 sank 3.3%. The MSCI ACWI dropped 3.5%. The Bloomberg BarCap US Aggregate Bond Index was functionally unchanged for the second week in a row.

Our hope is fundamental factors, such as earnings and the January jobs report, receive most of the focus this week. More likely, the companies that moved sharply last week will remain top of mind.

Figure 1

Investing Isn’t a Game

Suddenly, everywhere we go the stock market is on everyone’s mind. Traditional topics of conversation like the Super Bowl are being replaced by talk about the market. Or, to be more precise, people are talking about a handful of stocks that have increased rapidly in price. People are curious to understand the parabolic and volatile rise in prices of stocks and how it’s affected by short selling, option buying, and technological disruption.

For example, one video game retailer has recently received lots of attention. The company’s financials show it makes most of its revenue from a product that is being undercut by changing models in distribution. Some investors believed the business has too many headwinds to sustain the share price and amassed sizeable short positions that profit if the share price declines.

Shorting a stock is done by borrowing the stock from another investor and then immediately selling it. The hope is the stock will drop in value and can be repurchased at a lower price and returned to the original investor. Short investors are vulnerable when other investors become more positive about a company’s prospects. In the current environment, internet message boards or positive comments from well-known investors are fueling optimism about companies.

When the number of short positions becomes high, relative to the number of shares outstanding, any move higher in the stock can create panic buying by short sellers. The increased buying contributes to higher prices and is often referred to as a “short squeeze.” The combination of increased demand from buyers and short sellers closing out positions by buying the stock can push stocks higher.

Another contributing factor to the volatility last week is the explosion in options market activity. Some options, called call options, allow investors the “option” to buy a stock at a given price, referred to as the strike price. In this case, individuals bought call options at a strike price above the current price in hopes the stock would increase. The option seller must manage that risk of the position on their book by owning the underlying stock based on how close the option is to the strike price.

As the stock goes up in value, the number of shares needed to manage the risk becomes larger. When the stock moves sharply, option sellers need to increase the number of shares they own rapidly. Last week, short sellers were buying shares to cover large short positions at the same time. The surge of buying interest created a large imbalance, and the share price surged. Of course, the increasing stock price attracted others to the opportunity, further fueling the rally.

All these factors contributed to the self-feeding frenzy. Each increase in price fuels the demand for additional shares. As soon as the spike in one stock fueled a massive increase, speculators started looking for other stocks where the same situation might occur. Because of it, the rally broadened.

But frenzied activity often wears itself out. As things slow down, people move on to something else they find more interesting. That’s OK if you are moving from one online game to another. It isn’t OK if these assets are tied to a serious goal. We invest for real reasons and seek to profit from the real ingenuity and innovation of companies in order to reach our long-term goals.

The whole episode reminds us of the quote from Benjamin Graham: “In the short-run, the market is a voting machine, but in the long-run, the market is a weighing machine.” At some point investor sentiment may shift or the rally may run out of people to keep feeding the frenzy. Then, the fundamentals will return and some people may experience painful losses. Tread carefully.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.bea.gov/news/2021/gross-domestic-product-4th-quarter-and-year-2020-advance-estimate

Compliance Case: 00940513